Solo 401 K Contribution Limits 2024 Over 55

Solo 401 K Contribution Limits 2024 Over 55. First, when i tell you that the overall contribution limit for both types of accounts is $69,000 in 2024, this might sound like a trick question. The only exception is individuals ages 50.

But there are some key differences that. For 2024, the max is $69,000 and $76,500 if you are 50 years old or older.

The Limit On Employer And Employee Contributions Is.

What are the new solo 401k contribution limits for 2024?

The 2023 Limit Was $22,500.

Solo 401 (k) roth 401 (k) limits.

For 2024, The 401 (K) Contribution Limit For Employees Is $23,000, Or $30,500 If You Are Age 50 Or Older.

Images References :

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), The maximum employee contribution for 2024 is $19,500 ($27,000 for individuals aged 50 or older). The 401(k) contribution limit is $23,000.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, This is up from $66,000 and $73,500 in 2023. Contribution limits for simple 401(k)s in 2024 is $16,000 (from.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, Each year, the irs determines the maximum that you and your employer can contribute to your roth 401 (k). While market returns are key, even more essential is the amount one saves over time.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, The average 401(k) participant with a balance over $1 million, according to. The limit on employer and employee contributions is.

Source: shaylawemmey.pages.dev

Source: shaylawemmey.pages.dev

401k 2024 Contribution Limit Irs Over 50 Moira Lilllie, This is up from $66,000 and $73,500 in 2023. You can make solo 401 (k) contributions as both the employer and employee.

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, The average 401(k) participant with a balance over $1 million, according to. As an employee, individuals can defer all their compensation up to the annual contribution limit of $23,000 for 2024.

Source: millennialmoneyman.com

Source: millennialmoneyman.com

Solo 401k Contribution Limits for 2022 and 2024, Max roth 401k contribution 2024 over 55. The only exception is individuals ages 50.

Source: lanettewsofia.pages.dev

Source: lanettewsofia.pages.dev

Annual 401k Contribution 2024 gnni harmony, 401 (k) contribution limits 2024: The limit on total employer and employee contributions.

Source: www.ultimateassets.com

Source: www.ultimateassets.com

401(k) Contribution Limits Everything You Need to Know Ultimate Assets, What you need to know. The 401 (k) contribution limit is $23,000 in 2024.

Source: www.mysolo401k.net

Source: www.mysolo401k.net

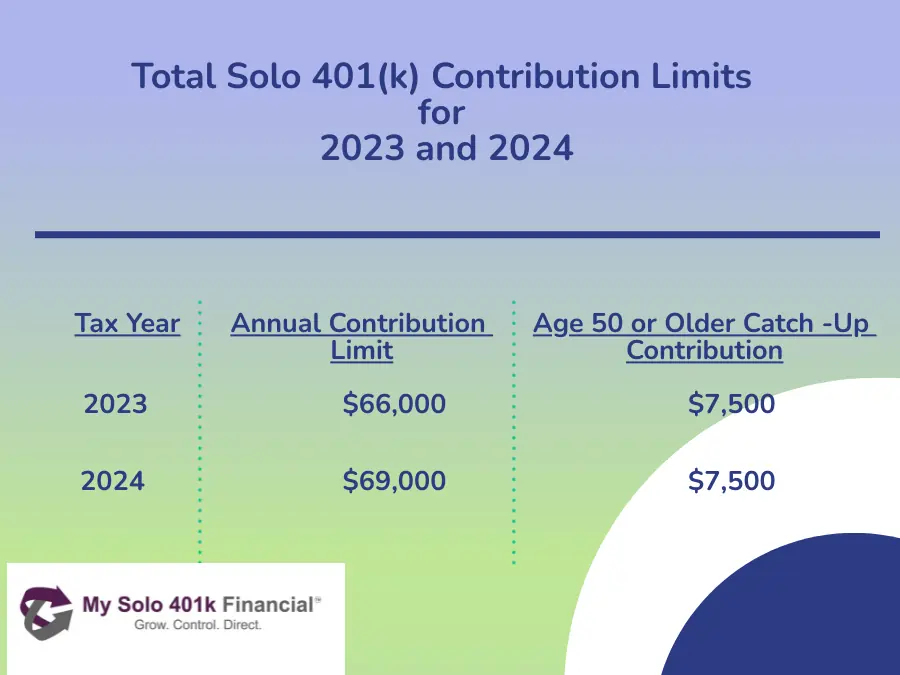

TotalSolo401kContributionLimitsfor2023and2024 My Solo 401k, The 401 (k) contribution limits in 2024 have increased for employees to $23,000. For 2024, the solo 401(k) maximum contribution limit for the elective deferral is $23,000 if you’re age 50 and under.

The 2024 401 (K) Individual Contribution Limit Is $23,000, Up From $22,500 In 2023.

In 2024, employers and employees together can contribute up to $69,000, up from a limit of.

What Are The New Solo 401K Contribution Limits For 2024?

You may be able to contribute up to $69,000 in 2024.